AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110050 - Free SAP FICO Certification by SLA Consultants India

AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025

As artificial intelligence (AI) continues to evolve, it is transforming various sectors, including accounting. While AI and automation can enhance efficiency and reduce human errors in routine tasks like bookkeeping, the role of accountants is far from becoming obsolete. In fact, by 2025, human expertise will remain indispensable due to the complexity, ethics, and strategic aspects of accounting that AI cannot fully replicate.

1. Human Judgment in Financial Decision-Making

Accounting is not just about number crunching; it involves critical thinking, analysis, and decision-making. While AI can process vast amounts of data and offer insights, it lacks the ability to interpret those insights within a specific business context. Human accountants use their expertise to make judgment calls that align with a company’s goals, legal framework, and financial strategies. They consider nuances such as market conditions, business culture, and long-term goals, which AI cannot fully grasp.

2. Ethical and Regulatory Oversight

The role of accountants extends beyond just preparing financial reports; they also ensure that companies comply with legal and regulatory requirements. In India, for instance, accountants must stay up-to-date with changing laws such as the Goods and Services Tax (GST) regulations. While AI can help streamline processes, it requires human oversight to ensure compliance with ever-changing regulations. Furthermore, ethical dilemmas, such as balancing transparency with client confidentiality, require a level of judgment and discretion that AI cannot offer.

3. Strategic Advisory Roles

In addition to financial reporting, accountants are increasingly acting as strategic advisors to businesses. By analyzing financial data, accountants can offer actionable insights that influence business decisions, investment opportunities, and cost-saving strategies. AI can assist in these tasks by providing data analysis tools, but it lacks the human touch in understanding the broader business strategy and advising clients on the best course of action. As the role of accountants evolves to include advisory and strategic functions, human expertise will remain a key asset.

4. Emotional Intelligence and Client Relationships

Accountants build relationships with clients, offering personalized advice and understanding their specific business challenges. AI may help automate tasks, but it cannot replicate the human touch that is essential in establishing trust and rapport with clients. Emotional intelligence, empathy, and communication skills remain essential for accountants, particularly when dealing with complex financial situations or crises.

5. Upskilling and Certification Opportunities for Accountants

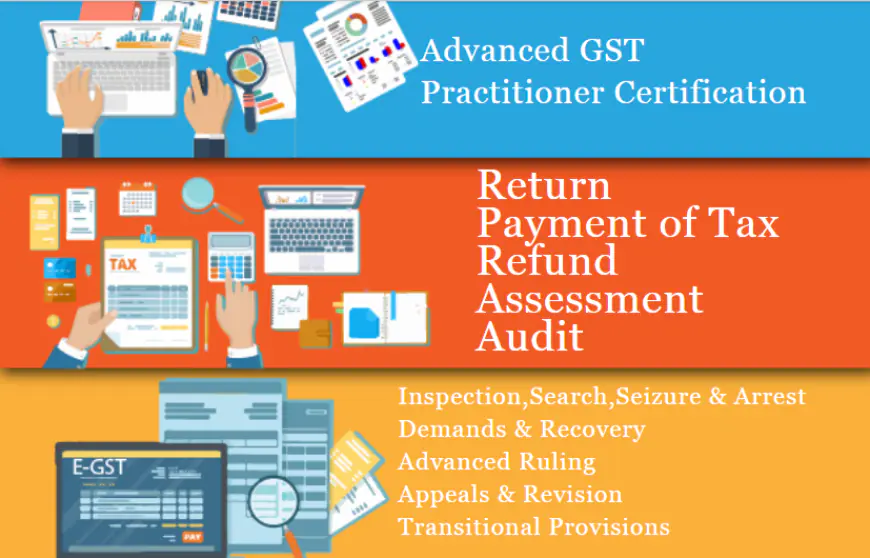

The accounting profession is evolving, and accountants who adapt to new technologies will continue to thrive. As AI automates routine tasks, accountants will need to focus on higher-value functions such as financial planning, analysis, and consulting. Continuous learning and certifications, such as the 100% Job-Guaranteed GST Course in Delhi, can help accountants gain the necessary skills to remain competitive.

Additionally, certifications like the SAP FICO (Financial Accounting & Controlling) certification offered by SLA Consultants India enhance an accountant's expertise in enterprise resource planning (ERP) systems, which are increasingly used by businesses to manage financial data efficiently. These certifications can help accountants stay ahead of the curve by equipping them with the latest knowledge and skills in finance and technology.

Conclusion

While AI will continue to revolutionize the accounting profession, human expertise will remain essential in 2025 and beyond. Accountants will continue to provide the strategic, ethical, and personal insights that AI simply cannot replicate. Upskilling through certifications and staying current with industry trends will ensure that accountants maintain their relevance in an increasingly automated world.

SLA Consultants AI vs. Accountants: Why Human Expertise Will Still Be in Demand in 2025, 100% Job, GST Certification Course in Delhi, 110050 - Free SAP FICO Certification by SLA Consultants India Details with "New Year Offer 2025" with Free SAP FICO Certification are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/

What's Your Reaction?